Continued…

BLURB: Real estate investing can be everything you dreamed it would be. But, (there’s always a but, isn’t there?) you need to steer clear of these common rookie mistakes or very soon that dream might turn out to be your worst nightmare.

-

Being Emotional About the Buy

Emotional investors usually fall into two groups – the ones who are driven to making rash decisions because of over-enthusiasm and the ones who are paralyzed into inaction because of over analysis. Most often, it’s newcomers who face such emotional upheavals and they would do well to remember that real estate investing is a business that needs to be run with an objective mindset. While it won’t get you anywhere if you’re paralysed by all the various options out there, it isn’t as bad as buying more property than you can handle; overpaying for a house because you didn’t stop to check the numbers; going overboard in improving the house; or, worse, improving a house according to your personal preferences.

To avoid emotional decision-making, develop a set of filters that help you analyze each deal. Make a list of the primary considerations a property must fulfill before you’re interested in it: Price, location, type of housing, neighborhood or the materials used in construction. Then, make a thorough analysis of the numbers –

- what is the After Repair Value (ARV) if you’re going to flip the house?

- what are the repair costs involved?

- what are the projected rental values, if you’re planning to buy and hold the property?

- what resale value can you expect if you’re planning to put it back on the market?

When you’re a beginner, it can get quite overwhelming to keep track of all these numbers and data. Which is why many investors seek more experienced partners or mentors with whom they can share the burden of making large financial decisions. It also helps them keep at bay any emotions that might influence objectivity.

-

Overpaying for the Property

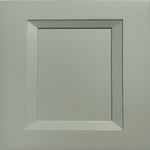

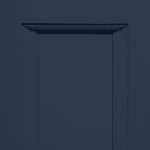

An important fallout of not doing proper research is overpaying for the property. A typical newcomer mistake, this can not only drive up your monthly payments (if you’re using financing), it can also reduce your profits when times come to sell. Most often, you’re overpaying because you’ve got the numbers wrong – you’ve either overestimated the ARV or underestimated the cost of repairs and rehab. As a novice, you probably aren’t yet confident about what improvements to the property will actually fetch you returns.

Also, many new investors tend to go about improving the property emotionally, getting hung up on things that a buyer wouldn’t even notice in the end, while missing out on fundamental areas that need improving. People who’ve just entered the field are the ones who don’t have too much money – however, it’s them who end up paying more for not just the property, but any professional services and expertise they use. That’s because they don’t yet have the insider knowledge of rates – a skill that can surely be developed over time. So, it’s always a good idea for beginners to do the following before making an offer:

- seek the advice of other experienced investors and mentors

- understand terms like lender pre-approval and buyer conditions

- do proper research into market rates and comps

- learn how to re-negotiate price after doing due diligence

Another important thing that new investors should keep in mind is the slight advantage they have as a buyer – even if this deal stalls or fails entirely, there will always be another deal just around the corner. They just need to be patient and keep looking for the property that’s perfect for their present circumstances.

-

Not Seeking Professional Help

If you’re just starting out, it might seem like a bad idea to spend money on professional services. You might even be convinced that you can or should handle all the work yourself – the home inspection, the calculation of resale/rental values, the legal paperwork to close the deal, the repair/ rehab work and later on the management of the property, if you’re planning to rent it out. While there’s no denying that it can all be done by yourself, you’d be losing valuable time, energy and maybe even money if you choose the DIY route. As a novice, you will most probably lack the expertise required to finish all the above jobs perfectly.

Which is why it’s always a good idea to hire professionals with a good amount of experience and great referrals. You can find referrals by

- networking at your local real estate club meetings

- speaking to contractors engaged in ongoing remodeling work in the neighborhood

- speaking to property managers who operate within the neighborhood

- asking mentors, family, and friends

While it’s important to seek professional help, do be warned that it’s really easy to get stuck with people who don’t really know what they’re doing. It’s imperative that you hire only those who come with great referrals; whose work you’ve had the chance to personally inspect; and who are willing to let you speak with their previous clients.

-

Not Budgeting for Ownership

Your capacity to the budget will stand you in good stead when it comes to real estate investing. Chalking out a budget that clearly shows what you can spend on the buy, the repair/renovation, and any future capital expenses can set you up for success in this industry. Doing so will help you analyze if a property is likely to be a positive cash flow property which, in turn, can help you decide whether or not it’s worth your time and money. Budgeting is a major area where novice investors routinely fail – and it all, once again, winds down to getting the estimations wrong and not doing enough research prior to closing a deal. Your budget will be off the mark if you’ve

- underestimated expenses

- overestimated returns

- not factored in capital expenses

- forgotten about hidden expenses

While capital expenses are issues that need large amounts of money to fix – like a roof that’s damaged by a fallen branch; structural frames that are rotting and need replacement; or, a heating system that needs to be completely overhauled. Hidden expenses include taxes, maintenance, and utilities, insurance, and association fees (if any).

Budgeting, with hidden expenses in mind, is particularly essential if your business strategy is to buy, hold and rent. Add to this your regular mortgage payments and any advertising costs to find tenants. So, even before you make your first bid, you need to have all your expenses figured out and budgeted for. At the beginning of your investing career, you’re unlikely to be ready to face any unexpected, big-ticket expenses – a situation which can turn your investment into a huge liability rapidly. So, do the math to save your business and keep the cash flow positive at all times.

-

Not Treating Investing Like a Business

Success will remain elusive as long as you don’t treat real estate investing like a real business. It cannot be something that you do on the side when you have the time. Sadly, many new investors want to test the waters before taking the plunge. While that might seem like the safer thing to do, that mindset won’t work in reality. You need to devote yourself to the job and leave your emotions at the door. The first thing that all investors should do is stop being the legal “owner” of the properties they invest in. Set up a legal, business entity, like a Limited Liability Company (LLC) that names you “landlord”. In this way, your personal assets will not be on the line, if things go south. Once you’ve done this, every decision you make must reflect well upon the financial health of your business entity.

Patience is Key

The first step to success is to acknowledge that the real estate industry is most definitely not a get-rich-quick scheme. It’s an industry where you can make money as long as you don’t make these rookie mistakes. Although this is a pretty long list of such mistakes, it is in no way exhaustive. In reality, you will learn more from the lessons that bad experiences teach you and if you’re patient, there are lots to be gained.